Choosing the right health insurance can be a daunting task. Many people find themselves needing coverage for a short period, whether it’s between jobs, waiting for open enrollment, or dealing with a temporary situation. Short-term health insurance might seem like a solution, but it’s crucial to weigh the pros and cons carefully. This post will explore both sides to help you make an informed decision.

Affordability and Cost Savings

One of the most attractive aspects of short-term health insurance is its affordability. Premiums are typically significantly lower than traditional plans. This makes it a viable option for those on a tight budget or facing temporary financial constraints. However, remember that this lower cost often comes with trade-offs in coverage, as discussed later.

Coverage and Limitations

Short-term plans are designed for temporary coverage, usually lasting a few months. They may offer basic coverage for accidents and illnesses, but they often exclude pre-existing conditions, maternity care, and mental health services. This limited coverage is a major drawback, and it’s important to understand exactly what’s included and excluded before enrolling. Carefully reviewing the policy document is essential. Learn more about policy details.

Eligibility and Enrollment

The eligibility requirements for short-term health insurance are generally less stringent than those for comprehensive plans. This makes it easier for individuals with certain health conditions to secure coverage, even if they might be denied by other insurers. Check your state’s regulations to see what’s available. The enrollment process is typically quicker and simpler than traditional plans. You can often get coverage within days.

Renewability and Extensions

Short-term plans are typically not renewable beyond a certain period. The maximum duration varies by state and insurer. While extensions may be possible under specific circumstances, they’re not guaranteed. Consider the potential need for extended coverage before you sign up. This is a key point to factor in alongside understanding your policy limits.

Alternatives to Short-Term Health Insurance

Before opting for short-term health insurance, consider alternatives like a COBRA plan (if eligible), Medicaid, or a marketplace plan. These options might offer broader coverage, although they may be more costly. Compare different plans here to make an informed decision.

Gaps in Coverage and Financial Risk

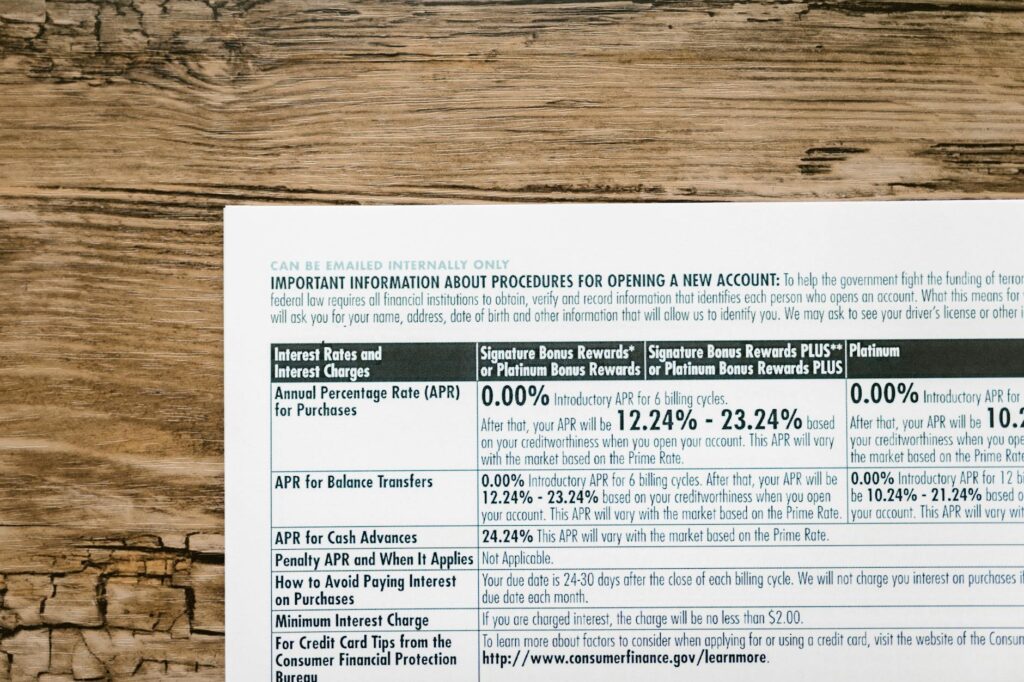

A significant concern with short-term plans is the potential for large out-of-pocket expenses. Since they often have high deductibles and limited coverage, a major illness or accident could lead to substantial financial burden. Consider whether you can comfortably manage this risk. For more information about managing financial risks associated with healthcare, read our guide on healthcare costs. [IMAGE_3_HERE]

Ultimately, the decision of whether or not to choose short-term health insurance depends on your individual circumstances and priorities. Weighing the benefits of lower costs against the risks of limited coverage is key. It’s strongly recommended to consult with a healthcare professional or insurance advisor to make the most suitable choice for your specific needs. Find an advisor near you.

Frequently Asked Questions

What happens if I need ongoing care while on a short-term plan? Short-term plans typically don’t cover ongoing care, leaving you responsible for significant costs. Consider carefully if you anticipate needing longer-term treatment.

Can I switch to a traditional plan after my short-term plan expires? Yes, you can typically transition to a traditional plan when the short-term plan ends, but be aware of potential waiting periods or pre-existing condition exclusions.

Are pre-existing conditions covered under short-term plans? Usually, no. Short-term plans often exclude coverage for pre-existing conditions, a key factor to consider. Make sure to check the specific policy details.

What are the typical lengths of short-term health insurance plans? These plans usually last from a few months to a year, but the exact duration varies widely depending on the insurer and your location.

Is short-term health insurance right for everyone? No, short-term health insurance may not be suitable for everyone. It’s advisable to assess your needs and risk tolerance carefully before opting for this type of coverage.